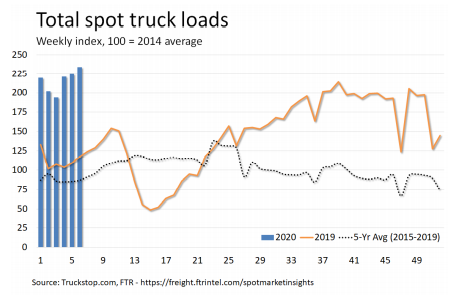

The FTR Experts were posed with the question, "Does the spot market “truck loads” mean how many times a truck was loaded with goods whether the truck was partially or fully loaded before it shipped? If yes, I’m trying to understand how this is possible given there is nowhere near a 150% increase in available trailers vs. a year ago. Also, I thought drivers were a constraint as well."

- Spot market only captures around 30% of overall truck freight.

- Loads are posted in the spot market because they cannot get capacity through their usual channels (called "route guides")

- Freight volume has essentially returned to pre-pandemic levels while driver capacity has not. The result has been a very sharp increase in active utilization, which is one of the factors in the sharp increase in freight rates.

FTR Expert Response:

The spot market represents only about 30% of overall truck freight, and its dynamics do not necessarily reflect what is happening in the broader market. Loads are posted in the spot market by brokers because they cannot get capacity through their usual channels (called "route guides"). Indeed, loads in the spot market often rise in large part due to constrained capacity as well as because of disruptions like weather, which is why the latest week was so extreme - both were in play. Technically, spot metrics do not even necessarily reflect actual movements as a load posting is not necessarily accepted by a carrier. However, we presume that at some point if a load needs to move it will find a taker. That said, it would be more precise to say "load postings" than to say "loads," and our commentaries generally make that distinction. In the broader market, we estimate that freight volume has essentially returned to pre-pandemic levels while driver capacity has not. The result has been a very sharp increase in active utilization, which is one of the factors in the sharp increase in freight rates.